Event Report: Webinar on Financial Inclusion – Legal and Policy Perspectives

The National Webinar on Financial Inclusion in India held by the Centre for Banking and Finance, Symbiosis Law School Hyderabad commenced with the welcome address by Ms. Anuradha Binnuri (Officiating Director, SLSH) followed by the introduction of the panellist Mr. Krishan Kumar Singh who is currently serving as an IPS officer prior to which he served as the manager of the Reserve Bank of India in the financial inclusion and development department.

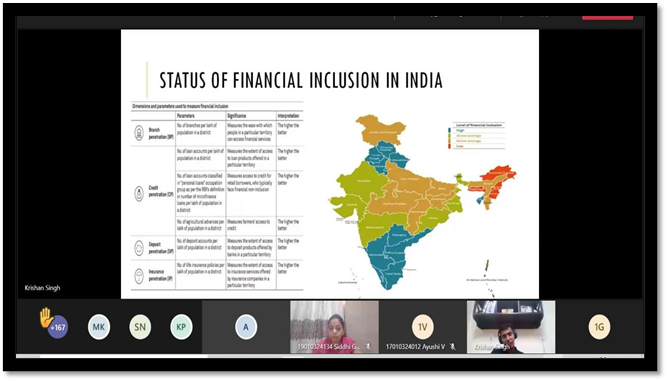

The webinar sought to discuss a variety of issues that were currently present in the country pertaining to financial inclusion across strata of society and in the terms of the steps that were taken by the RBI to address and mitigate the effect of the respective issues that existed. The session was divided into four broad aspects starting with what the concept of financial inclusion is and in terms of the various initiatives pertaining to the same that was carried out across low and middle countries. The speaker brought about numerous examples in developing lower-income countries and the steps/measures that were taken by them respectively to improve access to banking and other financial institutions. The speaker then proceeded to address the numerous manoeuvres that were taken up by India and in the past and at present, various initiatives like PMJDY and JAM trinity followed by the nationalisation of the banks across the country. Diverse district financial inclusions plans were implemented by the RBI to tackle the lack of representation with respect to financial facilities in the country.

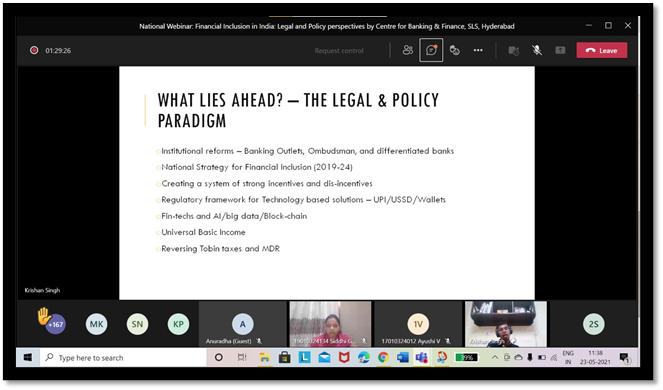

The speaker then proceeded to the third aspect of the session which related to the role of the RBI with respect to the implementation of the financial inclusion schemes that were set forth by the Government of India, every fiscal year. This included a range of measures that dealt with credit flows to MSMEs, financial literacy programmes, Credit flows to priority sectors and lastly strengthening institutional arrangements. The speaker also laid down the respective implementation plan that was to be followed with respect to ensuring effective implementation. Lastly, the speaker concluded the session by laying down respect to what was to carried out in the near future from a policy perspective as well, a few suggestions that were put forth were in relation to the Universal Basic Income, implementation of the National Strategy for Financial Inclusion (2019-24) and the use of big data as well as AI across the spheres. This was followed by an interactive Q&A session with over 300 participants who attended the event along with the vote of thanks after which the session duly concluded.